Like most millennial thirty-somethings, I love the holidays! It truly is the most wonderful time of the year and I enjoy every single minute I can. But the spending can start adding up faster than you realize. Here are five things I do so I don’t overspend or max out my credit cards during the holidays.

Being from Minnesota, where Christmases are usually white, it’s hard not to get totally sucked in and overdo it. The stores are holly jolly well before Thanksgiving (some even during Halloween). Holiday markets start early November and go right up until the weekend before Christmas. It’s everywhere…and so is the temptation to buy.

A past version of me would start the season with the best intentions. I would make a modest list of gifts I plan to give to people, write out a list of Christmas cards to send out, and decide what holiday treats to bake. Then I would assign some random dollar amount I gave no thought to, like $300, and that was what I thought I could comfortably spend on gifts, baking, cards, and anything else. All of a sudden, there’s a blur of red and green mixed with a caffeine buzz from my favorite holiday coffee drink, and I find I have completely overspent on gifts, decor, treats, charitable donations, themed clothing, and events…and I’m not even entirely sure how it happened.

This would happen to me Every. Single. Year. By January 1st I was working out a plan to get myself out of credit card debt from the holidays. As if it wasn’t insulting enough, usually by the time I paid it all off, it was almost time to start thinking about the holidays again. Wash, rinse, repeat.

But NOT ANYMORE! Last year (humble brag coming) was the first year that my husband and I paid cash for every single thing we bought and we came out of the holidays without any additional debt. It. Felt. AMAZING. And I want to share with you all some things that helped me not overspend and come out of the holidays comfortable, confident, and not stressing about money. Specifically, five things:

No. 1: I hate this one because it feels like it takes the fun out, but hear me out because it’s the most important one. Make a budget. Take a realistic look at your upcoming bills, what your paychecks will be until Christmas, if you have any money saved, and carefully decide how much is a comfortable amount for you to spend. Then, stick as close to that budget as possible.

This budget should include gifts for family, friends, teachers, neighbors, etc., lights or decor, experiences including plays, concerts, or events, clothing/holiday outfits, holiday cards + postage, baking and holiday meal supplies, charitable donations, and anything else you can think of that you might possibly spend money on over the next two-ish months. I also recommend having a “slush” amount of 10% for any additional expenses that may come up during the holidays that you weren’t anticipating.

Write. It. Down. Keep a copy where you can refer to it often. Keep a digital copy in your phone. Look at it when you need to. And share it with your spouse, family member, close friend, coworker…someone who you can feel accountable to and you know will keep you honest about it.

You’ll feel so much better during and after the holidays without worrying about how much you spent or maxing out your credit cards because you overspent. Big tip: Your budget should reflect what you can afford. Don’t go broke trying to be the best gift-giver or to keep up with the rest of your friends and family. On a personal note, some of my favorite gifts I’ve ever received have been hand or homemade. Great gifts do not have to be expensive! They can be heartfelt.

Not sure how to start? Check out My 2024 Holiday Season Budget where I show the budget that my husband and I made together. You can even download a blank copy to print and fill it out yourself, or if you prefer digital you can click this link to fill it out from your phone or computer, totally free.

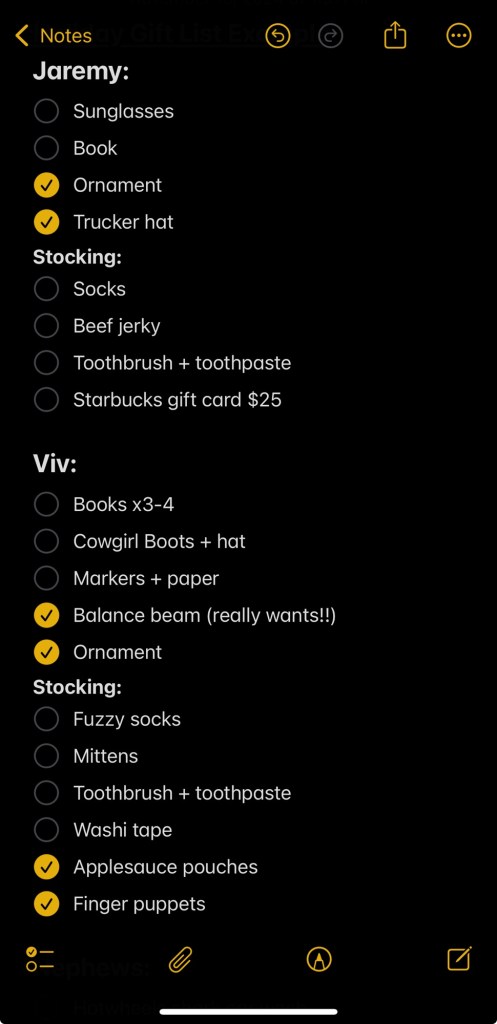

No. 2: “Making a list and checking it twice” isn’t just for Santa! But just like Santa, make sure you do both. Part 1: Make a gift list for everyone you are buying a gift for, and shop around for the best prices. Part 2: Check it off when you have purchased the gift, ESPECIALLY if you shop online. There have been several times I’ve accidentally bought someone an extra gift because I forgot what I already got them, which ends up being a waste of time and money.

Also, when you’ve got packages coming every other day, it can be hard to remember what you ordered for who and to keep straight what you already bought. (See example below ⬇️).

No. 3: Limit gift basket purchases. Unless you really are leaning into convenience, which you’ll pay for in cost and shipping, you can usually build your own version cheaper, or find better products than what’s included in the prepackaged one.

Here’s some brutal honesty…I’ve received a few gift baskets in my life and, with the exception of one, I have thrown them all away. They didn’t even make it out of the packaging before they ended up in my trash bin. Or it sits in a cabinet until I find it again 6 months later and then throw everything away.

Gift baskets are tough because they’re usually brand specific, product specific, or have a specific theme. Unless you know for certain someone’s favorite brand, preferred scent, or they actually asked for it…you run a big risk of them actually not liking it or using it. Which is a big waste of money for you. There is a way you can still do a gift basket, only better!

Find an example of what you’d like from the store, catalog, or website and shop the pieces individually (don’t forget the actual basket or whatever you’re using to hold everything!). I would say 9/10 times I can do it myself cheaper and better, and it’s honestly a more thoughtful gift because you are hand picking things yourself instead of sending a generic pre-made product including a card you didn’t even sign yourself.

No. 4: Don’t be tricked into free shipping. I see you because I am you. I LOVE free shipping. It physically bothers me when I don’t get free shipping on my purchase. My eye twitches and I have to stop myself from adding more to the cart just to see FREE next to the shipping charge. However, if you do not need anything else and you would have to spend more just to get it…you are being tricked into spending more money on purpose. Do not girl math your way out of this. Do real math and decide if you’ll really be saving money on shipping or if you are spending an extra $25 on something you truly don’t need or want, or can’t gift to anyone.

In order to really maximize your dollar, make a rule for yourself not to shop online unless you are spending enough to get free shipping. This doesn’t mean spend as much as you can! It means that you are deciding to buy what you need from one place so you are ensuring you hit the free shipping amount (which is usually around $50). If you aren’t spending enough, find an alternative at a local shop, boutique, or store where you can pick it up.

No. 5: Remove guilt from your holiday shopping list. .:Inhales deeply, exhales slowly:. I want to say this carefully, but firmly. If it is not in your budget to buy a gift for someone, do not buy a gift for them.

I’ve done this with friends and family in the past. I feel like it’s something we’ve all been through. Here’s an example—you receive a gift from someone you weren’t expecting to receive a gift from and suddenly feel incredibly guilty for not buying them something too, which triggers you to go buy them something you weren’t planning on buying in the first place. Or, you find out from your mom that her sister that you never see or speak to got you a gift for Christmas and is dropping it off when she visits because she has other plans on Christmas, and suddenly you feel obligated to reciprocate the gesture.

I can’t be the only one who has ever been through this stress. I say this with love, but if that person was not someone you thought of when you made your holiday shopping list…you do not need to feel guilty for not buying them a gift. Say a very gracious “thank you,” send them a holiday card with a personal handwritten note thanking them for thinking of you, and move on.

I also think it’s worth mentioning that you should not feel guilty if you clearly didn’t spend as much on them as they did on you. The reverse of this is also true. I always consider it such a sweet gesture when anyone (including my family) thinks to include me in their gift giving. Not only did they think of me in the first place, they took time to choose a gift and spent their hard earned money on me. It really is the thought that counts. Certainly not how much money is spent.

There you have it! Five tips for not overspending during the holidays. Remember that the holidays are not about how much you can spend on everyone. There is also a ton of value in hand making gifts to give, which is often inexpensive and fun, especially if you have kids. Check out My Top 5 Favorite Homemade Gifts for some ideas to stretch your budget even further!

Leave a comment